3 key CPG trends shaping the industry in 2026

Key takeaways

Our 2026 food and beverage study uncovered three key fast-moving consumer goods (FMCG) trends shaping the industry and how to work around them

How consumers discover products is changing rapidly and so should your promotion methods

Consumers in the US, UK and Australia are distinct from each other in terms of consumer behaviour and preferences

You can create an optimal 2026 trade strategy for each market by focusing on price optimisation, flavour innovation and brand differentiation

Executive summary

For the past 13 years, TELUS Agriculture and Consumer Goods has conducted an annual large scale food and beverage study of consumers to uncover key FMCG industry trends. This study surveyed 3,098 consumers aged 18+ across the US, UK, and Australia. The sample was balanced to reflect each country’s census distribution by age, gender, income, ethnicity and region. Conducted via the TELUS Shopper Insights research platform, the survey examined shopping behaviour over the past year across 18 major food and beverage categories.

In this report we found:

Price is the top purchase driver across all three markets

Flavour is a powerful differentiator, with more than 50% of consumers prioritising flavour and 59% willing to switch brands for unique flavours

In-store decision making is the norm globally, with 55% of consumers deciding what to buy at the shelf

So what do these insights mean in practice? They point to a clear path for building trade promotion strategies that work for each market.

Reshape your trade strategy

Three factors influencing consumer behaviour and FMCG trends

The rules for consumer packaged goods have changed, are you ready to play? In our new white paper, The FMCG playbook: winning with price, flavour and brand, we uncover critical global and regional insights, share how to craft your ideal trade strategy by product category and reveal the ultimate trade strategy.

Everyone in the FMCG space is navigating a new reality. Our study revealed there are three key factors driving change in the FMCG industry:

Economic pressure

Price war fatigue

Loyalty erosion

This shift has led to three major FMCG trends:

Economic pressure has led to price dominance

Price war fatigue has pushed brands to focus on flavour innovation

Loyalty erosion has necessitated brand differentiation

Price dominance

Inflation is cooling but consumer caution is ever present. That’s why price is the top influencing factor for consumer decision making:

Price is the #1 purchase driver across all three markets

70% of UK consumers are seeking deals

If you can’t compete on price, you must convince consumers that their products still have good value. Regional scenario planning can help your business optimise its approach and promotions can help you showcase product value.

In the UK, the rise of EDLP (Everyday Low Price) models at stores like Aldi, Lidl, and Asda has shifted the focus to supply chain efficiency. This puts pressure on manufacturers to compete on cost rather than promotional budgets, which erodes margins.

Flavour innovation

You can’t continuously compete on price without destroying your margins, so flavour innovation has become a viable escape route from price competition:

52% of consumers prioritise flavour

59% of consumers will switch brands to enjoy unique flavours

If you want to stop slashing your prices, shift your focus to flavour innovation with incremental trials. You can also explore co-branding partnerships and regional flavours to attract locals to try your products. To minimise risk when you step outside the box and optimise your trade spend, you can test your new flavour concepts virtually before you launch them.

In Australia, Heinz ran an “UnBEANlievable” campaign, unveiling bold new flavours like Taco and Peri Peri instead. The campaign turned heads and inspired consumers to choose Heinz – at full price.

Brand differentiation

Traditional brand loyalty is fragmenting, so you must work harder than ever to earn it. Your goal for 2026 should be to differentiate yourself at the shelf because:

60% of consumers in the UK decide at the shelf

55% of consumers globally decide at the shelf

To stand out more in store and earn more dollars, you should focus on unique product positioning (think functional benefits, clean ingredients, sustainability etc.) or try strategic advertising campaigns to grow and maintain their brand recognition.

In the UK, brands like Clipper Teas, Ella’s Kitchen, Graze and Pukka Herbs are adopting sustainable packaging to differentiate themselves in a tough market.

How current FMCG trends affect product categories differently

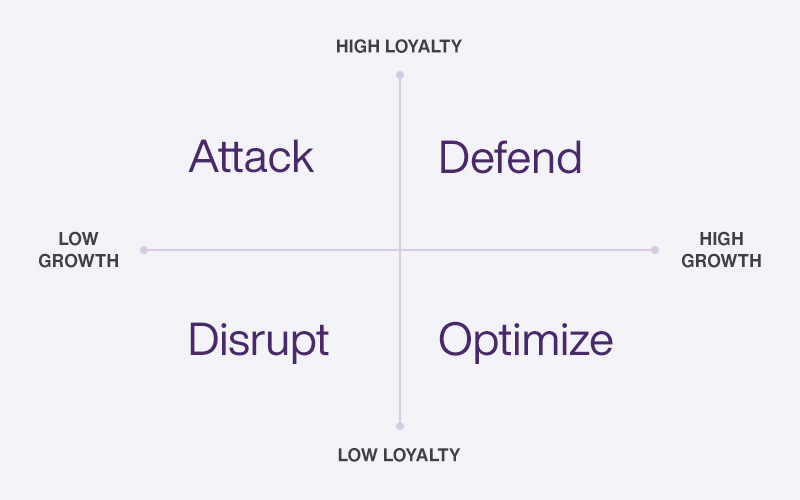

The three key factors have had a distinct impact in every product category. Their influence will determine which trade tactics will work best for your category:

Economic pressure hits low-growth categories hard

Price war fatigue offers opportunities in high-growth, low-loyalty categories

Loyalty erosion is a big struggle for high-loyalty categories

You can figure out whether you should attack, defend, optimise or disrupt within your product category with our trade strategy checklist. It will pinpoint your category’s position in the market and provide you with the right high-level strategic approach to adopt.

Promotion discovery is changing

How shoppers discover your products and promotions is changing fast. We’ve discovered that using a variety of tactics (think digital engagement paired with traditional methods like coupons and mailers) will be optimal in 2026. That being said, you’ll still need to tailor your marketing mix based on your target consumers and product categories to maximise your reach and impact.

Every market we surveyed has its own unique consumer profile. To succeed in these markets in 2026, you’ll need to tailor your sales and loyalty strategies by location. In our white paper, we examine how Australians, Brits and Americans compare and contrast and what FMCG manufacturers like you can do to earn their dollars and pounds.

Australia

Insight: Australians are a budget-conscious crowd

Proof: 26% of Australian consumers are on tight budgets

Strategy: Smart discount strategies are helpful in this market

United Kingdom

Insight: Brits are in-store decision makers

Proof: 60% of UK consumers decide on brands at the shelf

Strategy: In-store advertising is critical in the UK

United States

Insight: Americans are brand loyalists who love value

Proof: 67% year-over-year increase in deal seeking behavior among US consumers

Strategy: Capture their attention with special offers and discounts

UK consumers make decisions in store

If you sell to UK consumers, it’s critical that you focus your energy on in-store execution. When it comes to Brits, we discovered:

60% decide on brands at the shelf (vs. 52% US) and 38% rank pack size as a top-three decision-making factor

45% are willing to pay a sustainability premium (highest in the three markets surveyed)

28% purchase from social media ads (highest)

If you sell to UK consumers, it’s critical that you focus your energy on in-store execution. If you want to make your products stand out even more on the shelf, consider promoting your sustainability efforts. You can use our retail execution software to ensure shelf compliance. Online advertising is also influential in this market so get creative in your promotions.

Gen Z: The underestimated consumer

You can’t lump all UK consumers together under one customer profile. The most distinctive and underestimated consumer group in the world today is Gen Z. We partnered with Tastewise, a marketing and revenue activation platform, to gather more insights on this buzzworthy generation:

They have serious buying power, spending about $360B+ annually

They’re picky and want to buy innovative, buzzworthy and authentic products from brands with values they align with

Their flavour-first mentality drives their decision making

Gen Z consumers are your next best customers. If you want to appeal to them, they’ll need your full attention – in any market you sell in. The bulk of the battle for pounds will happen in your R&D, branding and at the shelf, so invest accordingly in shopper insights and your retail execution strategy.

Creating a winning trade strategy

You can set your brand up for success by prioritising the three key factors in your trade promotion and retail execution strategy in 2026:

Price optimisation

Flavour innovation

Brand differentiation

Your strategy will require retailer buy in, R&D investment and tradeoffs across your portfolio – but the investment will pay off. You can get started by grabbing our checklist to make an optimal 2026 trade strategy in our white paper.

How TELUS solutions can help you in 2026 and beyond

TELUS Consumer Goods is a global leader in end-to-end enterprise planning, operating across retail and foodservice. Our software solutions can help you plan and execute a winning trade strategy in 2026 and beyond. They’ll enable you to make data-driven decisions around price optimisation, flavour innovation and brand differentiation.

Price optimisation solutions

You can use TELUS Shopper Insights to test pack architecture configurations to identify your ideal size/price combinations. You can also use TELUS Trade Promotion Management for scenario planning so you can better navigate economic uncertainty and optimise all your promotional strategies.

Flavour innovation solutions

Shopper Insights can be used to conduct virtual testing for new flavours of your products. Tastewise’s menu insights are built right into our Sales Enablement solution and will help you reduce launch risk when you step outside the box.

Brand differentiation solutions

You can use TELUS Retail Execution to monitor compliance on premium placement, ensure that POS materials highlighting your key attributes are present and positioned correctly and confirm that your brand stands out to consumers at the shelf. You can also use Shopper Insights to test which brand attributes and messaging drives the highest purchase intent.

The FMCG world is ever evolving and exceedingly challenging to navigate. Trade strategies that worked for you in the past will likely not hold weight for you in the future. TELUS is your ideal partner today and tomorrow. We keep our finger on the pulse so you don’t have to. Our data-driven solutions and expert team are equipped to help your brand adapt and thrive in the FMCG landscape – no matter what it throws at you.

Talk to a TELUS expert to discover how our solutions can future-proof your business.

Frequently asked questions

What does FMCG mean?

FMCG stands for fast-moving consumer goods. They’re everyday, non-durable products people buy often and use quickly. Think groceries, toiletries and cleaning supplies.

What does deciding at the shelf mean?

Deciding at the shelf means a consumer makes the decision to purchase a product after encountering it in store on the shelf. Find out how your brand can win at the shelf.

Where can I find deeper insights?

You can take a deeper dive into our 13th food and beverage study findings by downloading a copy of our white paper, The FMCG playbook: winning with price, flavour and brand.