Build for scale

Leverage deep insights from our global business, offering investment partners a pathway to real-world traction and growth, while shaping a friendlier future.

TELUS Global Ventures is building what’s next

Unmatched insight, operational firepower and global reach across 160 countries. We don’t follow industry standards, we set them. If it matters tomorrow, we’re shaping it today.

Where we invest

Digital Health

Driving better health outcomes through modernizing digital health, strengthening data interoperability and enhancing personalized care.

Agriculture & Consumer Goods

Solutions that connect the field-to-fork supply chain using technologies like robotics and data analytics.

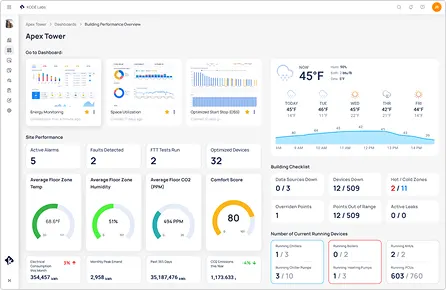

Enterprise Platforms & IoT

Powering the intelligent layer behind smart homes, infrastructure and industry. Turning data into responsive systems built for what’s next.

Connected Consumer Solutions

AI and digital enablement solutions for consumers plus solutions that help businesses automate and enhance the customer experience.

Impact

Climate response, food resilience, equitable health and better access to education and jobs, because the future should work for everyone.

Who we back. How we build.

We don’t just invest, we embed. TELUS Global Ventures partners with high-impact companies, bringing board-level guidance, unmatched scale and access to our full ecosystem. From incubation to global expansion, we help founders go further, faster.

Item 1 of 3

TELUS Global Ventures at a glance

Countries and territories reached globally through the TELUS ecosystem.

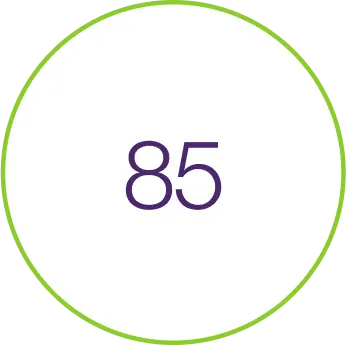

Innovative & market leading companies in the TGV portfolio.

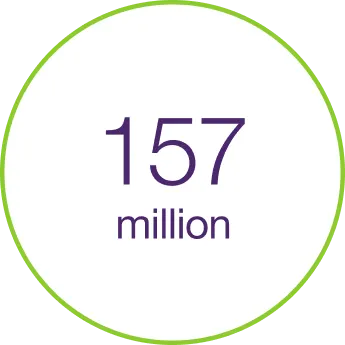

Lives enhanced through innovative preventive medicine and well-being technologies.

Digital customer connections.

Let’s build something together

Reach out to see how we can invest together.