New government incentives support business transformation

Tech Trends · Nov 23, 2018

On November 20th, Federal Finance Minister Bill Morneau outlined the Government of Canada’s Fall Economic Statement, which included incentives aimed at helping Canadian businesses seize new opportunities in an increasingly complex global economy.

Supporting businesses in their digital transformation through tax incentives

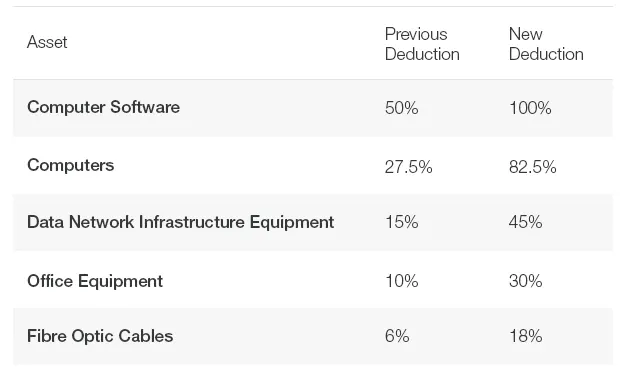

The Canadian government is implementing impactful changes to its corporate tax system, including the introduction of the Accelerated Investment Incentive, a capital cost allowance for businesses of all sizes. The key benefit of this incentive is an increase in the first-year tax deduction for depreciation, by up to three times the amount that previously applied under the Accelerated Capital Cost Allowance (ACCA). This upfront incentive provides businesses with accelerated financial recovery of their capital investment costs.

Impact of the proposed measures on technology assets

What this means for your business

This benefit comes at a critical time, as it rewards Canadian businesses for investing in infrastructure they require to compete in the digital era. Redefining your workplace to enable a fast, agile team that can collaborate and innovate anywhere, anytime, will directly impact your growth potential well into the next decade.

Learn how TELUS workplace solutions provide a significant opportunity for your business, or connect with a solutions expert who can help you build a roadmap and optimize your taxable deductions.